Cybersecurity in digital payments is critical to protect sensitive financial data, prevent fraud, and maintain trust in the digital economy. Proactive security measures are essential to defend against these evolving risks.

With every passing day, transactions such as peer-to-peer transactions, bill payments, and shopping are becoming digital payments. Online and digital payment security has now become a crucial issue, considering that transactions are becoming more digital in nature. With this, maintaining cybersecurity levels in digital transactions is crucial in order to sustain trust because cybercrimes that involve digital payments are becoming more common. When considering digital payments, robust security systems that protect information, prevent fraud, and sustain transactions at all times are crucial to secure digital transactions. The risks of financial as well as reputational losses faced due to a lack of security in digital transactions emphasize the need for secure gateways as well as overall security systems.

The Growth of Digital Payments and Rising Security Concerns

With the adoption of smartphones, internet access, and cashless initiatives, the use of digital payments has increased dramatically. People nowadays use Cards, UPI, mobile wallets, and online banking for digital payment methods.

With this fast growth, the vulnerability of people to online threats also increases. According to industry reports, global digital payment transactions are expected to cross trillions annually, with consistent double-digit growth each year. As the volumes of transactions grow, attackers find many ways to take advantage of vulnerable systems.

Since a single vulnerability may compromise millions of transactions, digital payments require advanced security controls for secure payment. Therefore, cybersecurity in digital payments is considered very important by companies, banks, and payment service providers throughout the world.

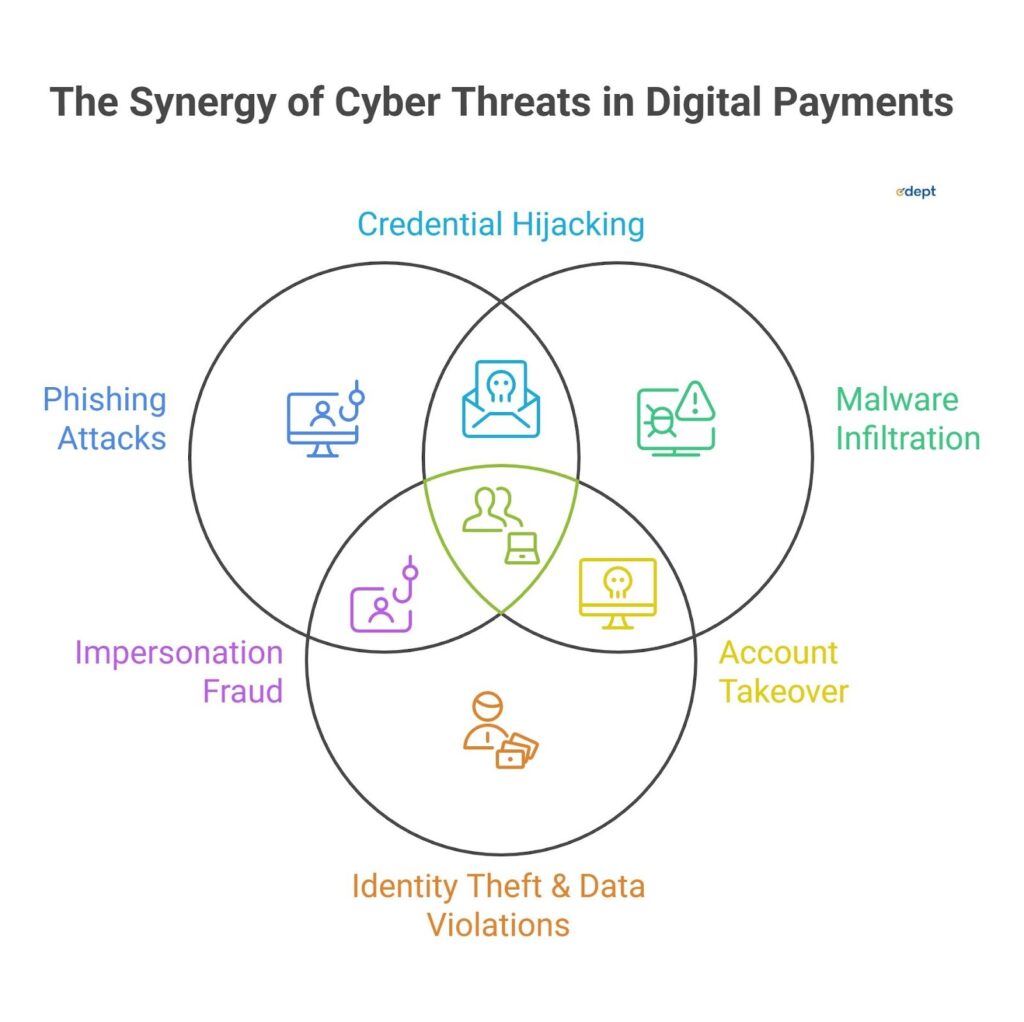

Understanding Cyber Security Threats in Digital Payments

Generally, cyber threats arising during digital payments are intended to steal confidential information or contaminate accounts. Consequently, users may lose their valuable information and face financial exploitation through poor security measures.

Phishing Attacks

Cyber threats targeting digital payments aim to steal sensitive data, hijack accounts, or manipulate transactions. Weak security practices can lead to unauthorized access and financial loss.

Malware Infiltration

A phishing attack consists of spam emails, messages, websites, and others that attempt to mimic well-known payment systems to deceive users into disclosing credentials and other financial information. A victim who is unaware of this attack, if he opens the infected file, loses his credentials.

Identity Theft and Data Violations

In order to pose as users, attackers steal financial and personal information, which results in fraudulent transactions and long-term harm to the security of digital payments.

Emerging Threats and Complex Fraud Schemes

In fact, sophisticated fraud schemes involve a combination of social engineering, automation, and breaches of data, thereby necessitating the development of a secure payment system, as fraud detection will be more complex in such cases. Indeed, cyber attacks are advancing day by day, therefore necessitating sophisticated fraud detection systems.

Also read: Importance of Cybersecurity Law and Compliance in India

Rise of Digital Payments Frauds

With an increase in digital transactions, there is also an increase in digital payment fraud. This is because cyber criminals are using the trust of users and their inability to secure their network to execute these frauds. This can occur in any person or any large company. The evolution of real-time payments is also removing some of the time for detecting fraud. This means security is a very important part of secure payments to enhance security and eliminate any losses.

Types of Common Digital Payments Frauds

Digital payment scams and fraud have risen with the use of electronic transactions carried out online or through mobile services. It should be noted that identifying common types of payment fraud will enable users as well as organizations to improve the security of the payment process carried out online.

Identity Theft

Identity theft involves the unauthorized stealing of information for the purpose of impersonating users. This information is normally used for unauthorized access to user accounts and for impersonating users during digital payment security breaches.

Phishing/Vishing

Phishing and vishing involve fraudulent messages in the form of emails, messages, or phone calls that access secret information like OTPs or passwords through fraud. These types of hacking directly target the security of digital payments through human error.

Masked QR codes

In some instances, criminals replace genuine existing QR codes with fake QR codes. A victim would not know they are sending money to the wrong account. This method seems to be on the increase in public areas and has some risks.

Web Skimming

Web skimming involves the use of malicious scripts that are injected into existing payment pages to steal card information when customers check out. This is done silently on secure payment gateways and online payment platforms.

Account Takeover

In account takeover, cybercriminals obtain access to a user’s account through a series of stolen credentials. They then misuse the stored payment methods, leading to various digital payment frauds.

The Cyber Security Pillars of Safe Digital Payments

Secure digital payment transactions require sound cybersecurity pillars to guard their sensitive information while also denying them access when needed. It is important to note that all these pillars intertwine to create a solid base for safe payment transactions while protecting them from fraud risks. It is important to use multiple security measures to guarantee security in payment transactions in the future.

Comprehensive Data Encryption

The use of encryption codes ensures the security of payments during transmission and storage. This is done through encrypting payments into unrecognizable codes. This ensures that in case of interception of any details during transmission, no one can read this sensitive information.

Strengthening Identity Verification

Identity verification methods such as multi-factor authentication and biometrics can be employed for user legitimacy. These will avert unauthorized access and ensure enhanced security in digital payments, thereby increasing the protection of users’ sensitive data and information.

Data Anonymisation with Tokens

Tokenization replaces sensitive data related to payments with unique tokens, which minimizes exposure in case of transactions. This reduces the possibility of data breaches and supports secure payment gateways. Some of its advantages include enhanced security, integrity of data, reduced compliance scope, and safety in the data-sharing approach.

Network Protection

Firewalls and intrusion systems help protect payment platforms from outside intervention. The protection of payment platforms through sound network protection measures ensures continuity in payment processing systems securely. Network protection helps organizations in providing secure systems and addressing challenges of compliance, such as GDPR and HIPAA regulations, while promoting business continuity and performance through reduced system downtime.

Patch Management

System updates and security patching address system vulnerabilities commonly abused by cybercriminals and hackers. Ineffective management of the patch could impact the integrity and robustness of the relevant digital payment systems from the impact of cybercriminals. Automated devices aid in the effective management and streamlined approach to the management of the whole patch management for disparate network domains through the use and management of the Scale-fusion tool alongside the N-able, Action1, and Rapid7 for the management of the whole patch generation to enhance consistency in the relevant environment.

Crafting a Secure Environment for Digital Payments

Establish a safe digital payment system by combining a combination of tech, regulations, and active monitoring. A business has to adopt safe security practices, including strong security practices for online payments. Online payments need security, and safe online payments help in maintaining trust with smooth transactions.

Choosing the Right Payment Gateway

Secure and reputable payment gateways are also mandatory when it comes to secure transactions. A secure electronic payment system will promise features and abilities in security and fraud detection, and will be extremely beneficial in electronic transactions. The best and leading electronic secure payment gateways in India are Razorpay, Cashfree, PayU, Stripe, and PayPal. Stripe and PayPal are preferred for the global operations of any company. The best electronic secure payment gateways available in India are Razorpay, Cashfree, and PayU.

Real-Time Prevention with AI

AI-based systems track transactions and instantly recognize suspicious behavior. This helps defend against digital payment fraud faster and more effectively. These functions are helping to revolutionize cybersecurity across various sectors, including financial fraud detection with Feedzai and industrial system security.

Regulatory Compliance

Conforming to standards like PCI-DSS ensures payment systems meet global security requirements. Compliance helps organizations keep their payment practices secure and low-risk regarding regulatory actions. Now is the time for organizations to think about security countermeasures at a large scale, both using AI-based firewalls and through secure application lifecycle management and runtime application self-protection to meet the ever-changing demands of regulatory requirements and security concerns in digital payment systems.

Cash-free Leading the Way As a Secure Digital Payments Gateway

Cash-free has been successful in securing its position as a safe digital payment platform because of its emphasis on the importance of security during the course of an online transaction through the use of efficient encryption methods in combination with online monitoring systems.

Through active detection and deterrence of such suspicious transactions and access, Cashfree helps businesses prevent fraud related to digital payments.

Offering various modes of digital payment options such as cards, UPI, and net banking, Cashfree has established digital payment security measures across platforms and modes. Being compliant with regulatory requirements and improving its services, Cashfree provides the highest standard in digital payment security.

Why Prioritising Cyber Security is Non-Negotiable for Digital Payments

Prioritizing cybersecurity in digital payment systems is not a choice but a necessity in the modern digital world, where the dependency for conducting financial transactions is as high as possible. Lack of proper cybersecurity in digital payment may lead to various types of financial losses. Cybersecurity in digital payment is the key to handling financial payments securely while maintaining confidentiality. Hence, it becomes essential to protect the sensitive user information while conducting the digital payment process.

Ending Notes: Why Cybersecurity is Essential in Digital Payments

As digital payments become ever more popular, cybersecurity will remain at the heart of safeguarding consumers, firms, and the whole financial system. It will involve fighting fraud, trusting online transactions, promoting safety in the whole process, and providing a secure payment gateway for secure payments. The responsibility for ensuring good cybersecurity in digital payment systems is shared among many stakeholders and parties. Investing in safe payment systems will be very important in securing the future of digital payments.

Related Links:

| Cybersecurity Career Roadmap 2026 | Cyber Security Course Eligibility: Check Requirements Here |

| Top 10 Emerging Cybersecurity Trends to Watch in 2026 | Data Privacy Laws in India 2026: What You Must Know |

FAQs of Securing the Future Digital Payments

How do AI and machine learning help prevent payment fraud?

AI and machine learning analyze transactions in real-time to detect any anomaly, thus ensuring fraudulent activities are recognized before any financial losses occur.

Why is two-factor authentication important for digital payments?

Two-factor authentication adds level of security to the system because it requires users to be authenticated through additional means in case their login credentials are compromised.

What are the risks of using public Wi-Fi for digital payments?

A large number of common users might use a publicly available Wi-Fi, which can remain compromised, allowing hackers to use or misuse information, steal login information, or use it to conduct payment-related cybercrimes.

What are the most common cyber attacks targeting payment systems?

Common attacks conducted by malware are phishing, malware injection, identity theft, web skimming, and hacking into the accounts of users.

How can users protect themselves from digital payment fraud?

As a user, one should use good password practices, two-factor authentication, avoid suspicious links, and use only safe payment options on sites.

What cybersecurity measures are critical for securing digital payments?

Some important measures to secure digital payments may include data encryption, a secure payment gateway, security updates, real-time monitoring, and access control.

Why is PCI-DSS compliance important for payment security?

PCI DSS compliance helps ensure an organization is employing standardized security best practices to safeguard cardholder information against breaches or violations.

How does selecting the right payment gateway enhance payment security?

It offers fraud detection tools, encryption tools, and compliance tools to facilitate safe and secure payment transactions through a reliable payment gateway system.

How does real-time fraud monitoring protect against cyber threats?

Real-time monitoring assists in detecting any suspicious activities on time and quickly taking counteractive steps to contain any financial and operational losses.